Apple Pay Later is a service offered by Apple that allows users to make purchases using their Apple devices and pay for them later in installments. It provides a convenient and flexible way for consumers to manage their finances, especially for larger purchases. With Apple Pay Later, users can split their payments into manageable chunks over time, helping them budget effectively and avoid financial strain. This service is integrated seamlessly into the Apple ecosystem, making it easy for users to access and use whenever they make purchases online or in stores.

Apple Pay Later is a feature that allows users to split purchases into four interest-free payments over six weeks when using Apple Pay in apps and online on iPhone or iPad. This service is designed with privacy and security in mind, offering no fees, no interest, and built-in tools to help users manage their spending. To use Apple Pay Later, users must be 18 years or older, a U.S. citizen or lawful resident with a valid U.S. address, have an eligible debit card set up with Apple Pay, and have two-factor authentication for their Apple ID.

Users can apply quickly at checkout without impacting their credit score and will know instantly if they are approved. The service is available for purchases between $75 and $1000 made on iPhone or iPad, with payments managed through the Wallet app. Apple Pay Later loans are managed within Wallet, allowing users to track payments, set up autopay, receive alerts for due dates, and access payment information easily.

Table of Contents

Apple Pay Later

Have you ever wanted to buy something but lacked the cash up front? You can make any purchases from a participating retailer using Apple Pay Later, then pay Apple back gradually. Let’s examine Apple Pay Later, its prerequisites, and how to configure it on your iPad and iPhone.

Apple Pay Later: What Is It?

With the help of the Apple Pay Later service, you may make a purchase from a participating retailer and have the entire amount paid for in four payments over the course of six weeks. You return the loan amount to Apple without any fees or interest, and Apple pays the merchant the full amount.

With an Apple Pay-enabled iPhone or iPad, you may use Apple Pay Later for online and in-app purchases between $75 and $1,000.

While applying for an Apple Pay Later loan has no effect on your credit, your loan and payment history may be reported to credit bureaus following your purchase, which could have an impact on your credit.

There is no impact on your credit when applying for an Apple Pay Later loan; however, after your purchase, your loan and payment history might be reported to credit bureaus and affect your credit.

Prerequisites for Apple Pay Later

To utilize Apple Pay Later, you have to:

- Have attained the age of eighteen. You must be at least 19 years old to be considered an Alabama resident.

- Be a citizen of the United States and provide a real address, not a PO Box. The US territories and New Mexico are not currently able to access the service.

- have installed on your device at least iPadOS 16.4 or iOS 16.4.

- To make an Apple Pay Later down payment, you must first set up Apple Pay with an approved debit card.

- Make sure your Apple ID is configured for two-factor authentication.

- Have two-factor authentication set up for your Apple ID.

- Obtain a state-issued ID card or driver’s license in case identification verification is necessary.

You might not be granted an Apple Pay Later loan even though you fulfill all the prerequisites. There are a number of reasons for this, such as your credit score and report, past Apple Pay Later purchases, and more.

Visit Apple’s official page to find out more about how loan applications for Apple Pay Later are assessed.

If you want to learn more, check out Apple’s official page on how Apple Pay Later loan applications are evaluated.

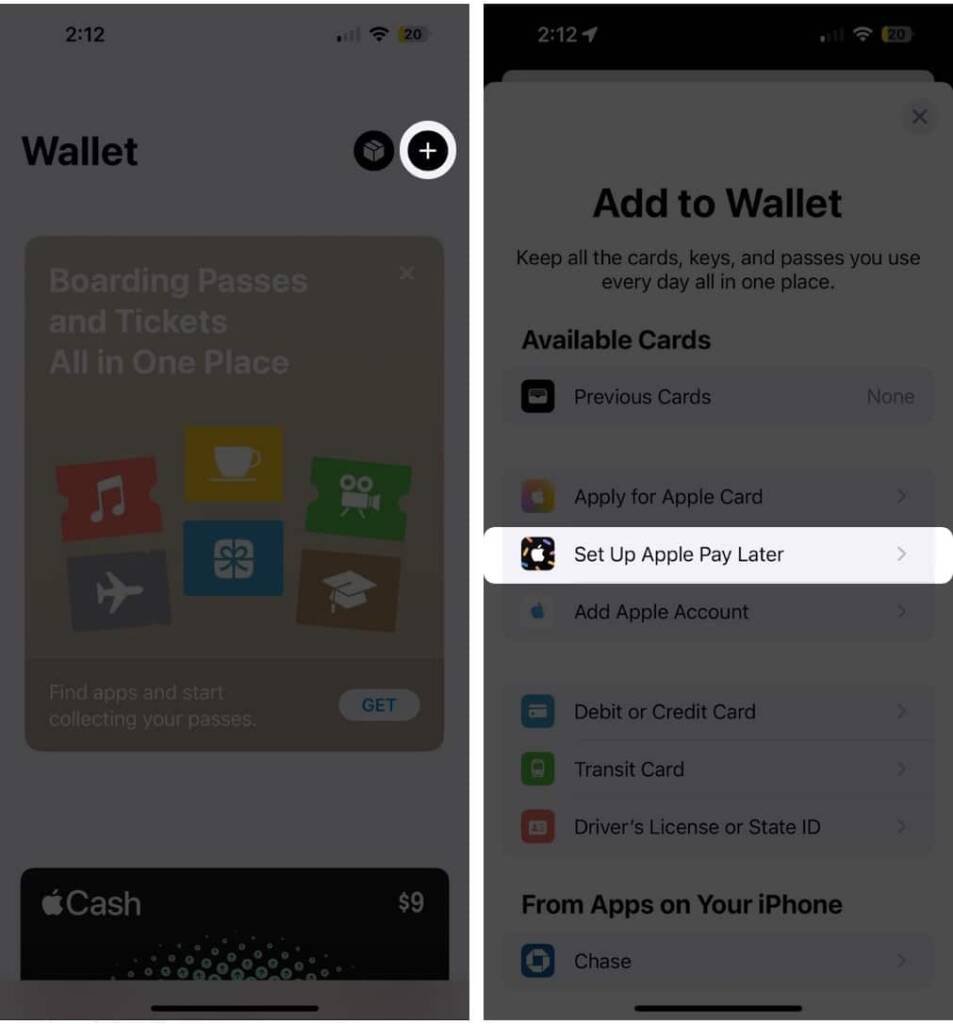

How to configure your iPhone or iPad for Apple Pay Later

Using the Wallet app, apply for a Pay Later loan as follows:

- Navigate to the Wallet app on your iPhone. Open Settings on your iPad, then choose Wallet & Apple Pay.

- Press the plus symbol (Add) button.

- Make sure to scroll all the way up and touch Done in the top left corner of the screen if you don’t see the plus sign.

- After selecting Set up Apple Pay Later, click Proceed. Click Next once you’ve read about how it operates.

- Please include the entire amount you are requesting, including shipping and taxes, when applying for the Apple Pay Later loan.

- After choosing Next, confirm your address, name, and date of birth.

- Verify the details, then select Agree & Apply.

- After reading the loan agreement and payment schedule, select Add to Wallet.

You have up to 30 days after receiving approval for the Apple Pay Later loan to complete your purchase. The amount that has been approved for you is displayed in the Apple Pay Later Available to Spend section.

At checkout, you can also choose to pay later with Apple Pay:

- Select Apple Pay at the register when using your iPhone or iPad to make a transaction.

- After carefully reading the terms, tap Pay Later and choose Continue.

- There might be some information about Apple Pay Later displayed. Once more, tap Continue.

- After completing your personal data, click Next in the upper right corner. After entering your zip code and address, press Next once again.

- Examine your personal data and make sure everything is correct. Click “Agree & Apply.”

- You must enter or choose the debit card you want to use to make the down payment after submitting your application. Next, to verify payment, double-click the side button on your iPhone.

All you need to do is fill out a few fields and you’ll be able to apply for an Apply Pay Later plan.

To address any specific queries, worries, or problems, get in touch with Apple Pay Later Support.

How to use iPad and iPhone with Apple Pay Later

Follow these instructions to use your Apple Pay Later Available to Spend balance from the Wallet app.

- When checking out, make the choice to use Apple Pay.

- Tap Continue after selecting the Pay Later tab.

- After reading the loan agreement and payment schedule, select Continue or Agree & Continue.

- Select the debit card you wish to use for the down payment, then adhere to the on-screen instructions.

- To verify your payment, double-click the side button and enter your passcode, Face ID, or Touch ID.

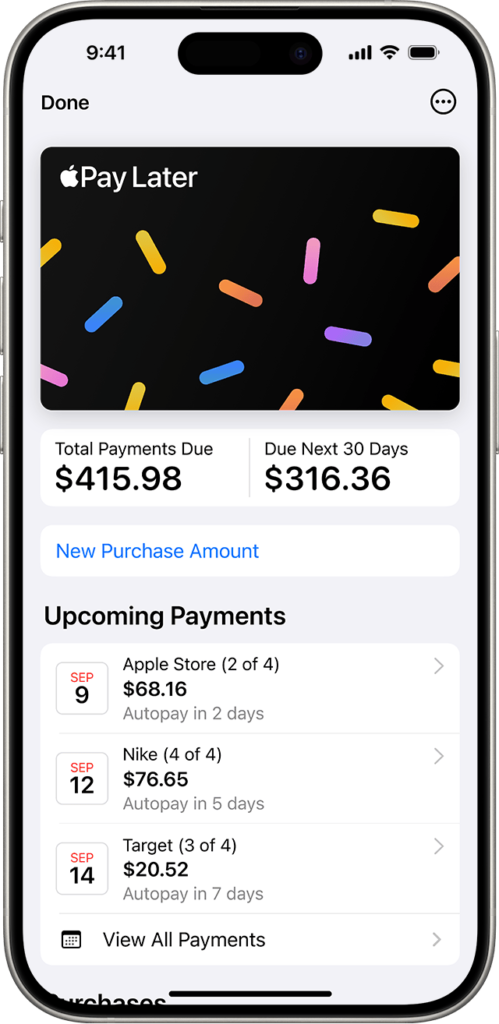

How to view the balance of Apple Pay Later

After receiving loan approval, you should find out how much is still owed and when your account will be debited. This is the method.

- Launch the Wallet application. Select Pay Later by tapping on the card list.

- This is where you may view the overall amount owed, the amount owed within the next thirty days, and the amount that you have previously paid.

- To get further details, tap the Pay Later plan located under the Upcoming Payments section.

In this section, you may also activate or deactivate autopay, which is useful if you want complete control over when money leaves your account or if you don’t want to forget to make a payment.

A convenient method of payment!

If you would want to purchase something but are unable to pay the full amount at once, Apple Pay Later is a handy feature that can assist you. Though it’s essentially a short-term loan, Apple offers a convenient way to pay with no fees or interest.

What say you? Will you attempt Apple Pay Later? Tell us if you can’t or why not!

For additional information, see how to use your wearable to make purchases by setting up Apple Pay on your Apple Watch.

For more, look at how to set up Apple Pay on your Apple Watch to make purchases using your wearable.

Unlock the Ultimate Potential: How to Harness iOS 17 on iPhone and iPad for Seamless Apple Pay Later Integration.

Mastering iOS 17: Your Guide to Effortlessly Embracing Apple Pay Later on iPhone and iPad.

Learn how to maximize iOS 17 features for smooth Apple Pay Later integration on your iPhone and iPad.

Discover the power of iOS 17 as we delve into seamless Apple Pay Later integration on your iPhone and iPad.

Unlock the Ultimate Potential: How to Harness iOS 17 on iPhone and iPad for Seamless Apple Pay Later IntegrationIn this comprehensive guide, learn how to unlock the full potential of iOS 17 on your iPhone and iPad to seamlessly integrate Apple Pay Later. From understanding the latest features to navigating the payment system effortlessly, this tutorial will equip you with the knowledge and skills needed to make the most of your devices. Whether you’re a seasoned iOS user or new to the platform, discover how to leverage iOS 17 for a smooth and convenient Apple Pay experience.

Dive into iOS 17 to effortlessly integrate Apple Pay Later on your iPhone and iPad, unlocking a world of seamless transactions and convenience.

In today’s digital age, mastering the latest advancements in technology is key to enhancing our everyday experiences. With the release of iOS 17, Apple continues to innovate, offering users a multitude of features designed to streamline tasks and elevate functionality. One such feature gaining traction is Apple Pay Later, a convenient payment option that allows users to make purchases and pay at a later date. In this blog post, we’ll explore how to harness the power of iOS 17 on your iPhone and iPad to seamlessly integrate Apple Pay Later into your daily routine. From setting up the feature to making secure transactions, join us on a journey to unlock the ultimate potential of your iOS devices.

How to Apply for Apple Pay Later

To apply for Apple Pay Later, you can follow these steps:

Apply in Apple Wallet:

- Open the Wallet app on your iPhone.

- Tap Add, then Set up Apple Pay Later, and continue.

- Follow the onscreen instructions to apply for an Apple Pay Later loan.

- Verify your name, date of birth, and address, then tap Agree & Apply.

Apply at Checkout:

- Choose Apple Pay at checkout on your iPhone or iPad.

- Tap the Pay Later tab, then Continue.

- Follow the onscreen instructions to apply for an Pay Later loan.

- Confirm your personal information and tap Agree & Apply.

- Review your payment plan information and loan agreement details, then tap Agree & Continue.

Check Available to Spend Amount:

- After setting up, you can apply for a New Purchase Amount at any time in the Wallet app.

- Select New Purchase Amount, enter the amount, review the Payment Plan Example, and tap Continue.

Remember that to use Pay Later, you need to be 18 years or older, a U.S. citizen or lawful resident with a valid U.S. address, have an eligible debit card set up with Apple Pay, and have two-factor authentication for your Apple ID.

what is the interest rate for apple pay later

Apple Pay Later offers a 0% interest rate for users, allowing them to split purchases into four interest-free payments over six weeks. The loan amount limit ranges from $50 to $1,000, and there are no fees associated with this service[1][2][3]. This feature is designed to provide a convenient and flexible payment option without incurring additional costs, making it an attractive choice for those looking to manage their spending effectively.

what is the maximum amount i can borrow with apple pay later

The maximum amount you can borrow with Pay Later is $1,000. This service allows users to apply for loans between $50 and $1,000, which can be used for online and in-app purchases made on iPhone and iPad with merchants that accept Apple Pay. The loan repayment is split into four interest-free payments over six weeks, providing a convenient and flexible payment option without incurring additional costs.

what is the approval process for apple pay later loans

The approval process for Pay Later involves a relatively straightforward procedure compared to most “Buy Now, Pay Later” (BNPL) providers. Users are typically asked to provide their payment details and purchase history during the application process. Approval is based on factors like credit report evaluation, and each loan request requires separate approval.

If a loan application is not approved for the total amount requested, it might be approved for a lower amount. In such cases, users can adjust their purchase amount, remove items from their cart, or switch to paying in full with Apple Pay. It’s important to note that factors like being a U.S. citizen, having access to Pay Later, and meeting eligibility criteria play a role in the approval process.

Stay connected with Taaz Khabar for the latest updates and news around the world! Follow us on Facebook and Instagram for exclusive and exciting content.

Join our Telegram channel and WhatsApp channel for the quick and latest updates in AUTOMOBILE, Bike, Car | BUSINESS | EDUCATION, How To, Results | ENTERTAINMENT,- Celebrities, Actor, Actress, – Influencer, – Movie, Bollywood Movie, Hollywood Movie, Tollywood South Indian Movie, – TV Reality Shows | ELECTRONICS, – Tech, – Gadget, Mobile, Laptop, Watch, | FINANCE | SPORTS, – Cricket, – Foot Ball | MORE, – Mix, Blog, News, Articles, | Others, – Game, – Technology, – Election, – Politics | REVIEWS | WEB STORIES and around the world!

Also, Read More Post Like This

Categories

Home | Blog | Education | How To

For more news and updates from the Education world, see How To stay connected with us at taazkhabar.com

If you enjoyed this story, then feel free to share it with your friends. Thank you for spending your valuable time on taazkhabar.com

Stay tuned for more entertainment updates and information on taazkhabar.com!

Happy Reading!

Good day! taazkhabar.com

Did you know that it is possible to send letters undoubtedly legally? We tender a legitimate and reliable way of sending commercial offers through contact forms.

Contact Form messages are usually not sent to spam, since they are viewed as important.

Get a free sample of our service!

Our service will take care of sending up to 50,000 messages for you.

The cost of sending one million messages is $59.

This letter is automatically generated.

We only use chat for communication.

Contact us.

Telegram – https://t.me/FeedbackFormEU

Skype live:contactform_18

WhatsApp – +375259112693

WhatsApp https://wa.me/+375259112693

Thank you for reaching out! If you have any specific questions or topics in mind, please feel free to share them, and I’ll do my best to assist you. Whether you’re curious about a particular technology, scientific concept, literary work, or anything else, I’m here to provide information, advice, or engage in a discussion. Don’t hesitate to let me know how I can help you further!